after tax income calculator iowa

If you make 55000 a year living in the region of Iowa USA you will be taxed 11457. Iowa Income Tax Calculator 2021.

Iowa Paycheck Calculator Smartasset

United States Italy France Spain United Kingdom Poland Czech Republic Hungary.

. This places US on the 4th place out of. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by.

Your average tax rate is 1069 and your marginal tax rate is 22. Filing 20000000 of earnings will result in 1135753 of your earnings being taxed. Corporations in Iowa pay four different rates of income tax.

Appanoose County has an additional 1 local income tax. If you would like to update your Iowa withholding. Calculating your Iowa state.

Compound Interest Calculator Present. Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The top marginal rate of 98 will remain in place until 2022.

After Tax Income Calculator Iowa. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. However the rates will be gradually reduced to meet the revenue.

Were proud to provide one of the most comprehensive free online tax calculators to our users. Fields notated with are required. Tax March 2 2022 arnold.

The Iowa Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. You can alter the salary example to illustrate a different filing status or show. If you make 62000 a year living in the region of Iowa USA you will be taxed 11734.

After Tax Income Calculator Iowa. Just enter the wages tax withholdings and other information required. Financial Facts About the US.

After Tax Income Calculator Iowa. After Tax Income Calculator Iowa. That means that your net pay will be 43041 per year or 3587 per month.

Calculate your net income after taxes in Iowa. - Iowa State Tax. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

You can alter the salary example to illustrate a different filing status or show. Tax Calculators Tools. The Federal or IRS Taxes Are Listed.

You can use this tax calculator. Filing 20000000 of earnings will result in 1201400 being taxed for FICA purposes. So the tax year 2022 will start from July 01 2021 to June 30 2022.

That means that your net pay will be 43543 per year or 3629 per month. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income. Tax March 2 2022 arnold.

This is only a high level federal tax income. Iowa tax year starts from July 01 the year before to June 30 the current year.

A Complete Guide To Iowa Payroll Taxes

Iowa Income This Calculator Can Tell You If You Are Upper Middle Or Lower Class

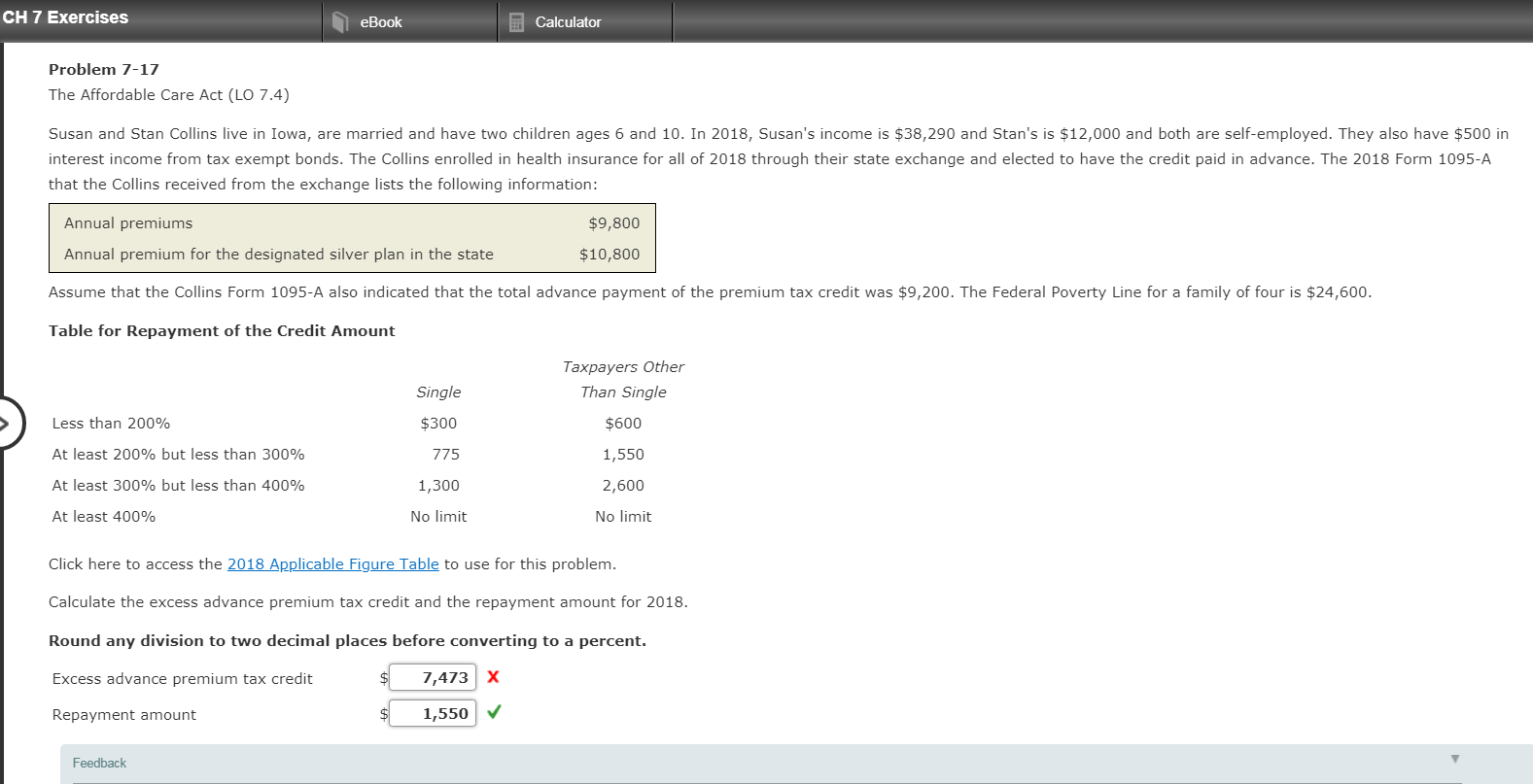

Ch 7 Exercises Ebook Calculator Problem 7 17 The Chegg Com

![]()

Free Iowa Payroll Calculator 2022 Ia Tax Rates Onpay

Those Crazy Iowa Property Taxes Home Sweet Des Moines

Tennessee Sales Tax Rate Rates Calculator Avalara

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Iowa Salary Paycheck Calculator Gusto

Income Tax Calculator 2022 Usa Salary After Tax

![]()

Iowa Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Changes In Sales Use And Excise Taxes In Iowa Uhy

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Income Tax Calculator 2022 2023

Iowa Paycheck Calculator Smartasset

How To Calculate Iso Alternative Minimum Tax Amt 2021

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable At Age 62

Why Give United States Community Foundation Of Des Moines County